Search AI Agent Marketplace

Try: Autonomous Agent GUI Agent MCP Server Sales Agent HR Agent

Overview

AI in Car User Reviews, AI in Car, Best AI in Car,AI Vehicles,AI in Car,AI Driving,Self Driving Car,Best AI Self Driving Car,Self Driving AI,Automotive AI,Automotive Artificial Intelligence,BMW AI,Benz AI,Tesla AI,AI Car Companies

Most Reviewed

Top Rated

IMAGE GENERATOR

CHATBOT ASSISTANT

Loading...

PRODUCTIVITY TOOL

Loading...

VIDEO GENERATOR

Loading...

HEALTHCARE

Loading...

EDUCATION

Loading...

FINANCE

Loading...

BUSINESS

Loading...

KIDS

Loading...

ELDERLY

Loading...

LAW

Loading...

ROBOTAXI

Loading...

ELECTRIC VEHICLE

Loading...

BUSINESS AND CORPORATE LAW

Loading...

ALL

Loading...

FANTACY

Loading...

INSURANCE

Loading...

CARTOON CHARACTER

Loading...

PERSONAL INJURY

Loading...

AI GIRLFRIEND

Loading...

ILLNESS

Loading...

DEBT

Loading...

STORY TELLING

Loading...

RESEARCH & ANALYSIS

Loading...

AI BOYFRIEND

Loading...

FANTASY

Loading...

TECHNOLOGY

Loading...

BREAKING NEWS

Loading...

PROGRAMMING

Loading...

STATISTICS

Loading...

HOBBY

Loading...

MATH

Loading...

TAX REFUND

Loading...

IMMIGRATION LAW

Loading...

DAILY LIFE

Loading...

INVESTMENT

Loading...

CELEBRITY

Loading...

FAMILY LAW

Loading...

RELATIONSHIP

Loading...

FOOD

Loading...

HISTORY

Loading...

Reviews

Tags

-

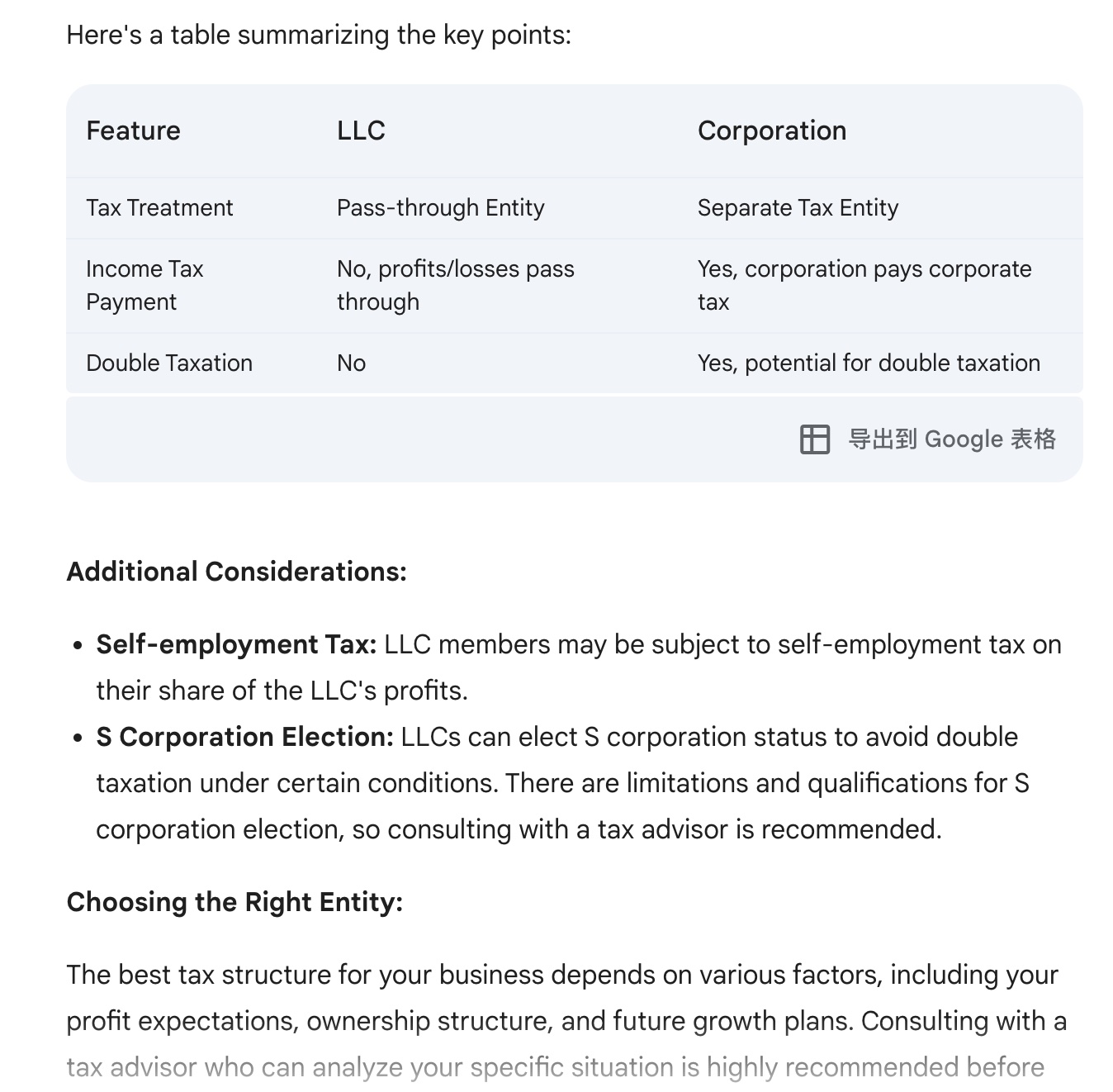

I asked Gemini a business and corporate law related question "What are the tax implications of forming an LLC vs. a corporation?". The answers from Gemini are amazing. The best part about the response from Gemini is that it not only lists the key points of LLC Tax Treatment (Pass-through Entity, Profits and Losses Pass Through, Tax Flexibility) and Corporate (Separate Tax Entity, Corporate Income Tax, Double Taxation). It also summarize the key results in a table comparing the difference in tax treatment between LLC and Corporate and provides some factors of consideration. The tabular display is really amazing. Prompt: You are a lawyer specialized in business and corporate law. I will consult you a few questions. And my questions include "What are the tax implications of forming an LLC vs. a corporation?"

![]()

![]()

-

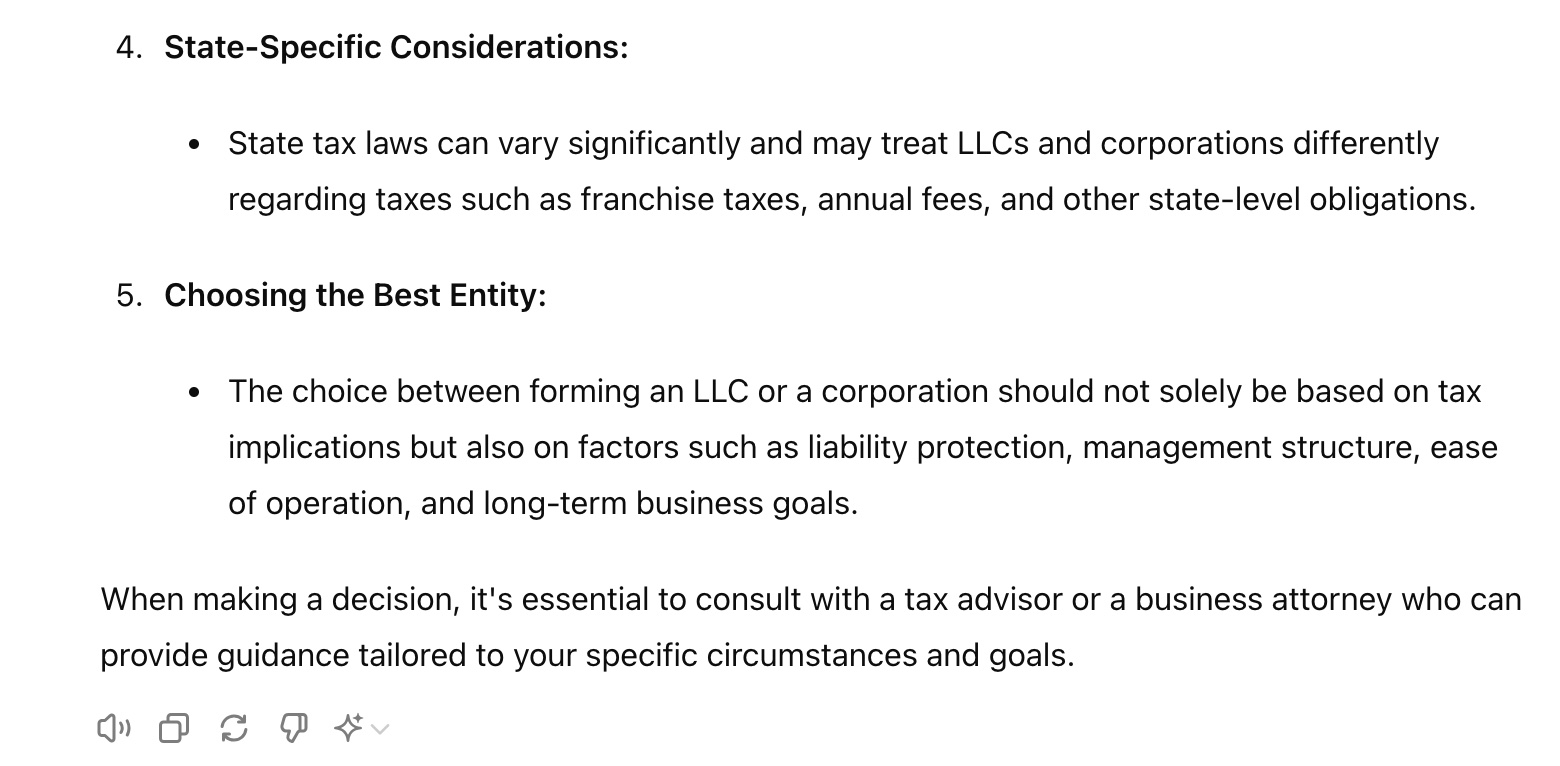

The results from ChatGPT is clear and informative. It lists 5 points to consider when choosing LLC VS Corporate, including: Pass-through Taxation vs. Double Taxation, Flexibility in Allocation of Income and Losses, Self-Employment Taxes, State-Specific Considerations and choosing the best entity.

![]()

![]()

Write Your Review

Detailed Ratings

-

Community

-

大家在使用可灵AI生成视频的时候遇到了哪些好的体验和有问题的体验?请务必写明prompt输入文本和视频截图or短视频clip

-

大家在使用抖音的即梦AI生成视频的时候遇到了哪些好的体验和有问题的体验?请务必写明prompt输入文本和视频截图or短视频clip

-

大家在使用快手(Kuaishou Kwai)短视频的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用小红书(Xiaohongshu)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用微信(WeChat)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用微信(WeChat)APP的AI问答功能的时候,遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用知乎(Zhihu)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用京东(JD)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用淘宝(Taobao)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用支付宝(Alipay)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用拼多多(PPD Temu)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用知乎直答(Zhihu)AI搜索功能的时候,遇到了哪些好的体验和有问题的体验?请麻烦写一下当时输入的条件,比如prompt输入文本,或者是上传截图。

-

大家在使用知乎直答(Zhihu)AI搜索功能的时候,遇到了哪些好的体验和有问题的体验?请麻烦写一下当时输入的条件,比如prompt输入文本,或者是上传截图。

-

大家在使用快手(Kuaishou)的AI搜索功能的时候,遇到了哪些好的体验和有问题的体验?请麻烦写一下当时输入的条件,比如prompt输入文本,或者是上传截图。

-

大家在使用抖音(Douyin Tiktok)的AI搜索功能的时候,遇到了哪些好的体验和有问题的体验?请麻烦写一下当时输入的条件,比如prompt输入文本,或者是上传截图。

-

Please leave your thoughts on the best and coolest AI Generated Images.

-

Please leave your thoughts on free alternatives to Midjourney Stable Diffusion and other AI Image Generators.

-

Please leave your thoughs on the most scary or creepiest AI Generated Images.

-

We are witnessing great success in recent development of generative Artificial Intelligence in many fields, such as AI assistant, Chatbot, AI Writer. Among all the AI native products, AI Search Engine such as Perplexity, Gemini and SearchGPT are most attrative to website owners, bloggers and web content publishers. AI Search Engine is a new tool to provide answers directly to users' questions (queries). In this blog, we will give some brief introduction to basic concepts of AI Search Engine, including Large Language Models (LLM), Retrieval-Augmented Generation(RAG), Citations and Sources. Then we will highlight some majors differences between traditional Search Engine Optimization (SEO) and Generative Engine Optimization(GEO). And then we will cover some latest research and strategies to help website owners or content publishers to better optimize their content in Generative AI Search Engines.

-

We are seeing more applications of robotaxi and self-driving vehicles worldwide. Many large companies such as Waymo, Tesla and Baidu are accelerating their speed of robotaxi deployment in multiple cities. Some human drivers especially cab drivers worry that they will lose their jobs due to AI. They argue that the lower operating cost and AI can work technically 24 hours a day without any rest like human will have more competing advantage than humans. What do you think?

Reply