Category

Overview

AI in COMMUNICATION Reviews, Best AI in COMMUNICATION

Most Reviewed

Top Rated

IMAGE GENERATOR

CHATBOT ASSISTANT

PRODUCTIVITY TOOL

VIDEO GENERATOR

HEALTHCARE

EDUCATION

FINANCE

BUSINESS

KIDS

ELDERLY

LAW

ROBOTAXI

ELECTRIC VEHICLE

BUSINESS AND CORPORATE LAW

Reviews

Tags

-

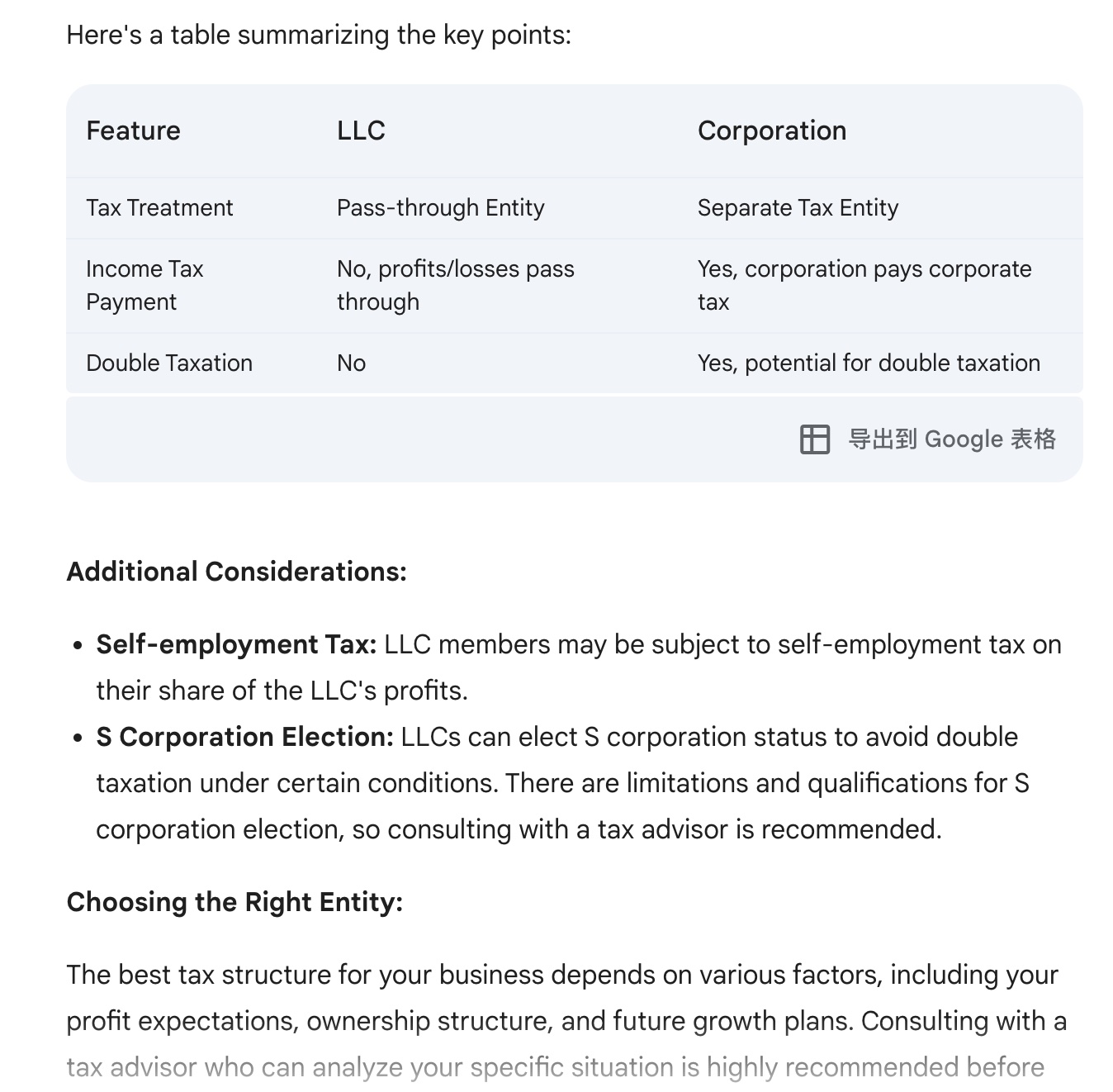

I asked Gemini a business and corporate law related question "What are the tax implications of forming an LLC vs. a corporation?". The answers from Gemini are amazing. The best part about the response from Gemini is that it not only lists the key points of LLC Tax Treatment (Pass-through Entity, Profits and Losses Pass Through, Tax Flexibility) and Corporate (Separate Tax Entity, Corporate Income Tax, Double Taxation). It also summarize the key results in a table comparing the difference in tax treatment between LLC and Corporate and provides some factors of consideration. The tabular display is really amazing. Prompt: You are a lawyer specialized in business and corporate law. I will consult you a few questions. And my questions include "What are the tax implications of forming an LLC vs. a corporation?"

![]()

![]()

-

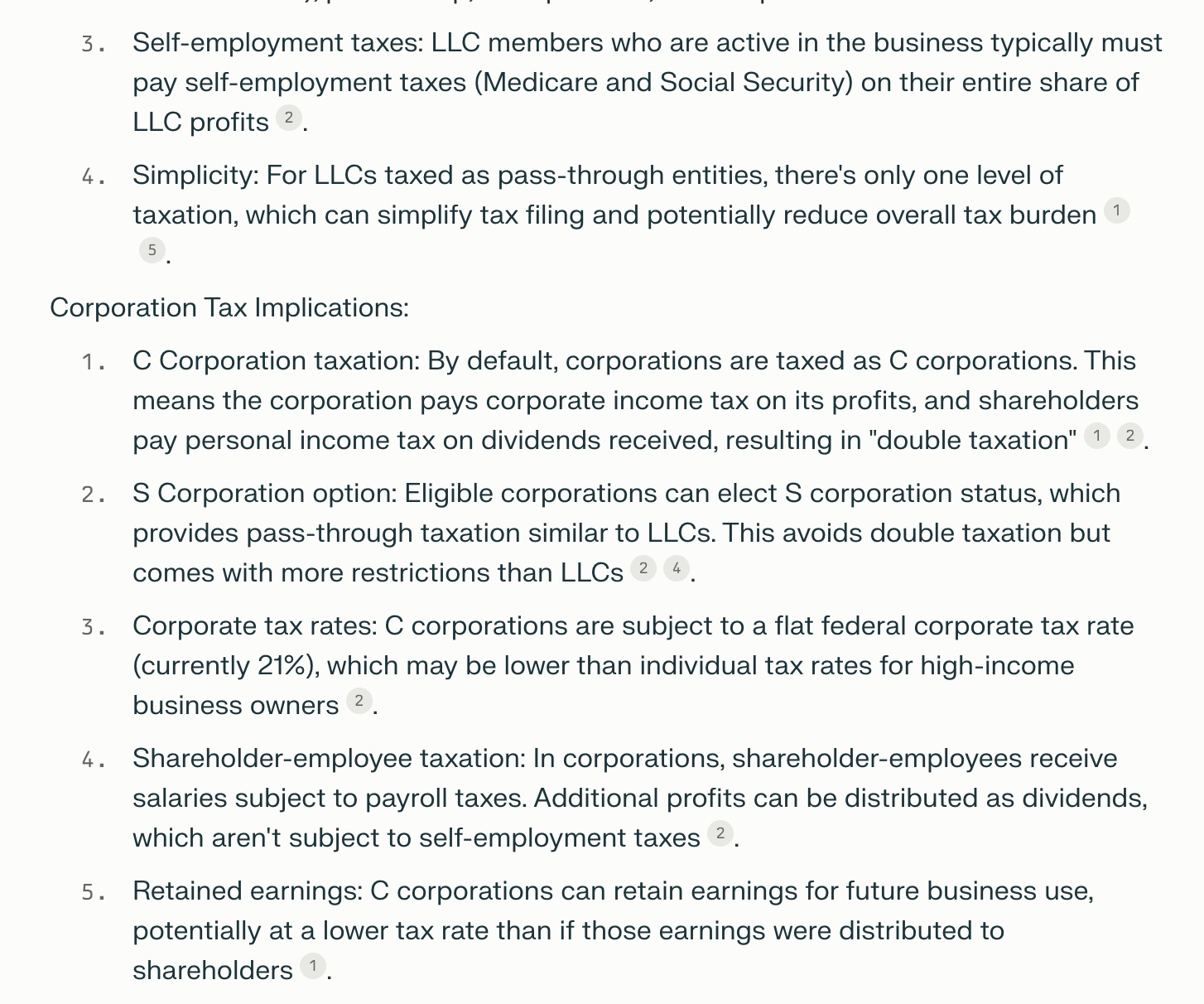

I asked perplexity the question "What are the tax implications of forming an LLC vs. a corporation?" And perplexity does a good job summarizing different tax implications of LLC and Corporation, including pass through taxation, flexitibility, etc. It also provides key considerations when choosing LLC VS corporation, which are from trustworthy data sources, including investopedia, etc.

![]()

![]()

![]()

-

The results from ChatGPT is clear and informative. It lists 5 points to consider when choosing LLC VS Corporate, including: Pass-through Taxation vs. Double Taxation, Flexibility in Allocation of Income and Losses, Self-Employment Taxes, State-Specific Considerations and choosing the best entity.

![]()

![]()

Write Your Review

Detailed Ratings

-

Community

-

大家在使用可灵AI生成视频的时候遇到了哪些好的体验和有问题的体验?请务必写明prompt输入文本和视频截图or短视频clip

-

大家在使用抖音的即梦AI生成视频的时候遇到了哪些好的体验和有问题的体验?请务必写明prompt输入文本和视频截图or短视频clip

-

大家在使用快手(Kuaishou Kwai)短视频的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用小红书(Xiaohongshu)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用微信(WeChat)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用微信(WeChat)APP的AI问答功能的时候,遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用知乎(Zhihu)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用京东(JD)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用淘宝(Taobao)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

-

大家在使用支付宝(Alipay)APP的搜索推荐Search and Recommendation 功能的时候遇到了哪些好的体验和有问题的体验?请麻烦写明复现条件,比如prompt输入文本,上传截图。

Reply